Self Employment Tax Calendar 2025 – If you’re self-employed tax bill will, in theory, already be covered. If after totting up the actual amount of tax due for 2023-24, the two advance payments don’t cover what you owe, you’ll then . When you’re self-employed, you’re responsible for paying both the employer and employee portions of taxes. Here’s how to calculate both. FICA taxes are the taxes that are taken out of your .

Self Employment Tax Calendar 2025

Source : found.com

Simpson & Simpson Accounting, LLC Important 2024 Tax Dates for

Source : m.facebook.com

Amazon.com: tax year diary 2024 2025: A5 Financial year diary week

Source : www.amazon.com

Simpson & Simpson Accounting, LLC Important 2024 Tax Dates for

Source : www.facebook.com

Tax Filing Deadline Dates 2024

Source : www.fusiontaxes.com

When Are Taxes Due? 2023 2024 Tax Deadlines TurboTax Tax Tips

Source : turbotax.intuit.com

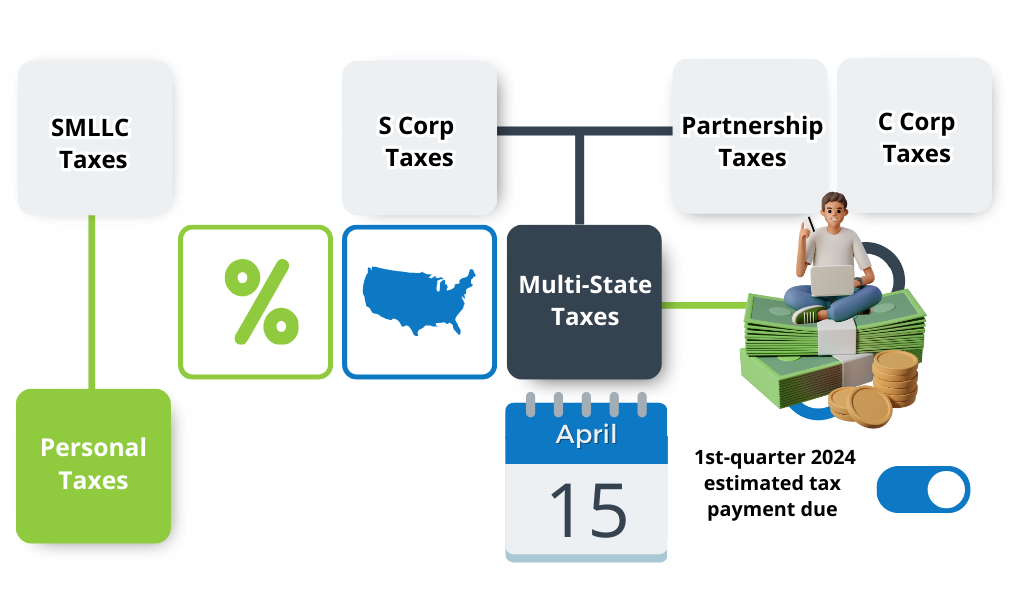

Quarterly Tax Date Deadlines for Self Employed Intuit TurboTax Blog

Source : blog.turbotax.intuit.com

Tax Filing Deadline Dates 2024

Source : www.fusiontaxes.com

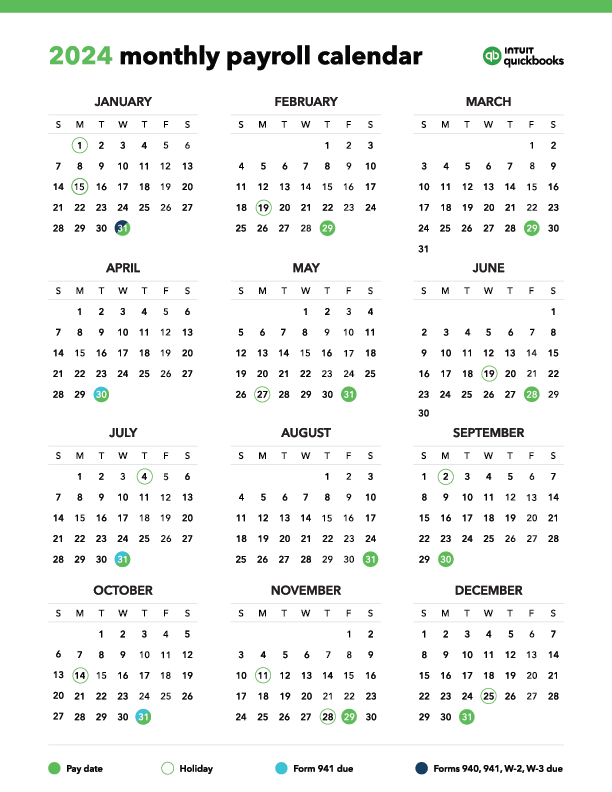

Payroll Calendar Templates 2024 2025: Biweekly & Monthly | QuickBooks

Source : quickbooks.intuit.com

Key Tax Dates For The Self Employed – Forbes Advisor

Source : www.forbes.com

Self Employment Tax Calendar 2025 2024 Tax Deadlines for the Self Employed: The self-employed usually need to do a Self Assessment tax return and pay their tax bill each year. This is a step-by-step guide on how to do a Self Assessment tax return, who needs to file one, and . Michelle is a credit expert, freelance writer and founder of CreditWriter.com. She has over 20 years of experience writing and speaking about credit and money, and focuses on helping families and .